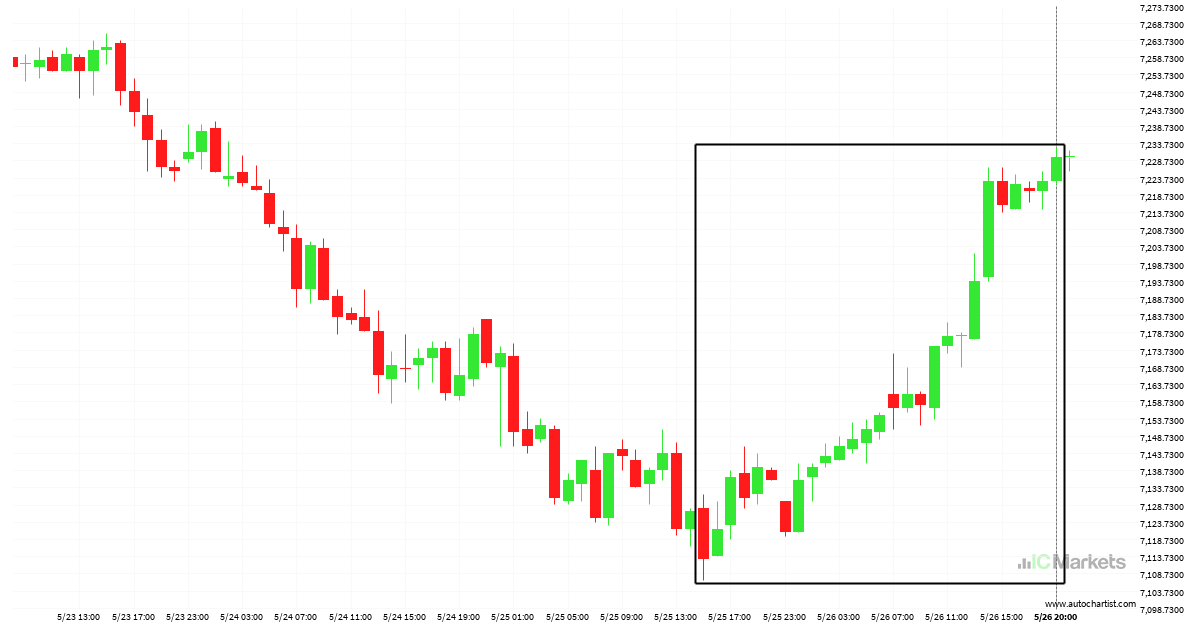

Huge bullish move on Australia 200 Index

Australia 200 Index has moved higher by 1.64% from 7112.78 to 7229.74 in the last 2 days.

FTSE China A50 Index approaching support of a Falling Wedge

FTSE China A50 Index is approaching the support line of a Falling Wedge. It has touched this line numerous times in the last 8 days. If it tests this line again, it should do so in the next 2 days.

Hong Kong 50 Index approaching support of a Falling Wedge

Hong Kong 50 Index is approaching the support line of a Falling Wedge. It has touched this line numerous times in the last 8 days. If it tests this line again, it should do so in the next 22 hours.

FTSE China A50 Index has broken through resistance

FTSE China A50 Index has broken through a resistance line. It has touched this line at least twice in the last 6 days. This breakout may indicate a potential move to 12941.3118 within the next 18 hours. Because we have seen it retrace from this position in the past, one should wait for confirmation of […]

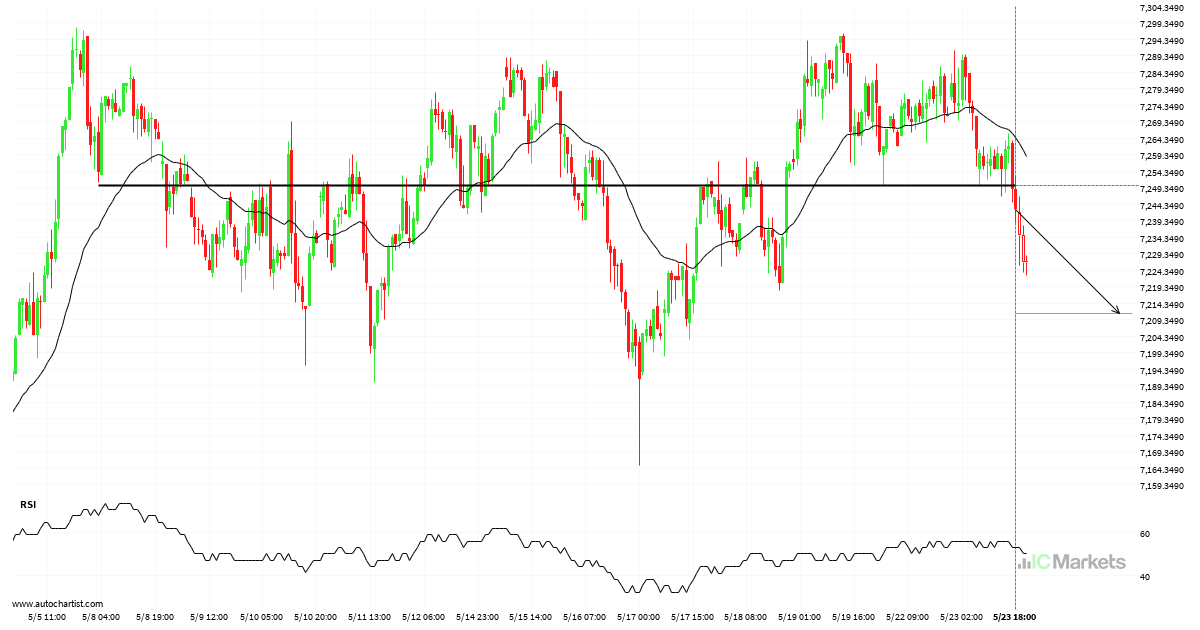

Australia 200 Index broke through important 7249.9399 price line

Australia 200 Index has broken through a support line. It has touched this line numerous times in the last 16 days. This breakout shows a potential move to 7211.3701 within the next 3 days. Because we have seen it retrace from this level in the past, one should wait for confirmation of the breakout.

Hong Kong 50 Index approaching support of a Falling Wedge

Hong Kong 50 Index is approaching the support line of a Falling Wedge. It has touched this line numerous times in the last 15 days. If it tests this line again, it should do so in the next 2 days.

FTSE China A50 Index has broken through resistance

FTSE China A50 Index has broken through a resistance line. It has touched this line at least twice in the last 20 days. This breakout may indicate a potential move to 13282.8857 within the next 3 days. Because we have seen it retrace from this position in the past, one should wait for confirmation of […]

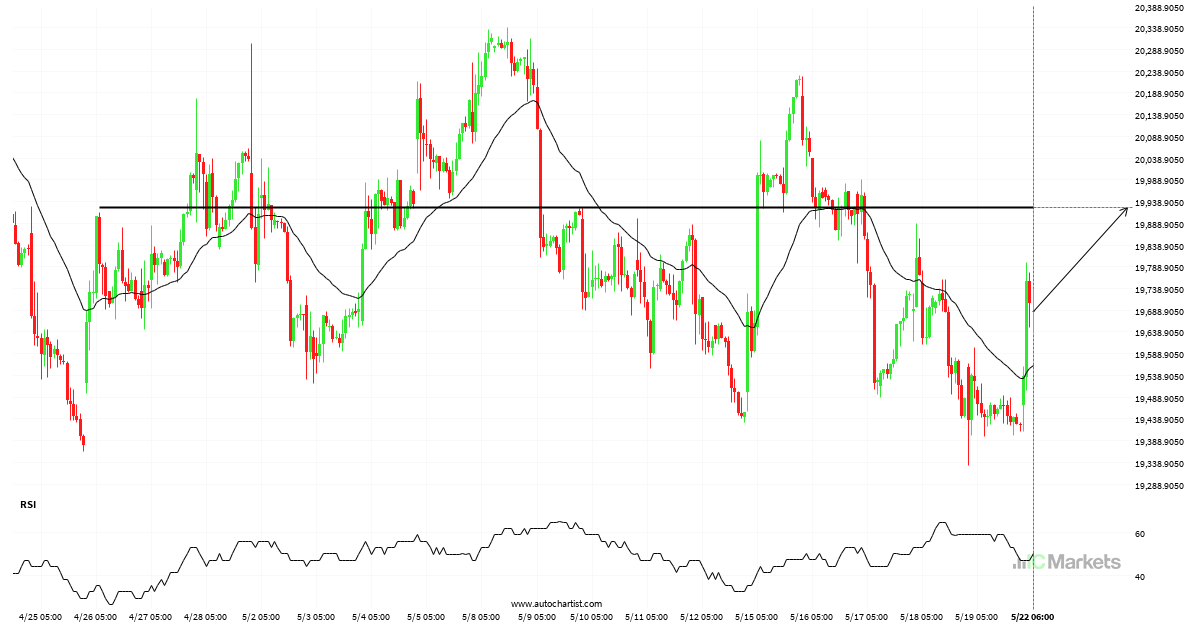

Hong Kong 50 Index – getting close to psychological price line

Hong Kong 50 Index is moving towards a resistance line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 27 days and may test it again […]

Hong Kong 50 Index approaching support of a Channel Down

Hong Kong 50 Index is approaching the support line of a Channel Down. It has touched this line numerous times in the last 2 days. If it tests this line again, it should do so in the next 5 hours.

FTSE China A50 Index approaching support of a Falling Wedge

FTSE China A50 Index is approaching the support line of a Falling Wedge. It has touched this line numerous times in the last 21 days. If it tests this line again, it should do so in the next 3 days.